Ira distribution tax withholding calculator

Your tax liability and any tax withholding you elect are based on your home legal address. Use our RMD calculator to find out the required minimum distribution for your IRA.

Taxtips Ca Rrsp Rrif Withdrawal Calculator

For federal taxes the distributions generally are included in income ratably over a three-year period starting with the.

. For income such as dividends interest distributions from an IRA not Roth IRAs 401k or a trust or other form of specialized income. If you are eligible you can make tax deductible contributions to a traditional IRA and accumulate earnings within the IRA tax-free until you are required to begin making withdrawalsusually in the year you turn 72. You can figure your allowable deduction using the worksheets in the Instructions for Form 1040 and Form 1040-SR PDF or in Publication 590-A Contributions to Individual Retirement Arrangements IRAs and claim your IRA deduction on Form 1040 US.

Division O section 111 of PL. Type of retirement plan IRA or qualified retirement plan State of residence for tax purposes. You do not need to show hardship to take a distribution from your IRA or annuity before age 59 12.

These distributions are subject to withholding for federal income tax at. So if you took 20000 from your 401k and that puts you in the 22 tax bracket you may only get about 1200013000 depending on state income tax when all is said and done. IRA contributions and student loan interest.

You might have received a lump-sum payment from your retirement plan. IRA contributions and student loan interest. Publication 505 Tax Withholding and Estimated Tax IRS.

2022 W-4 Help for Sections 2 3 and 4. However you can take. Your withholding is a pre-payment of your state income tax that serves as a credit toward your current-year state income tax liability.

Before Tax Retirement. Tax Return for Seniors attach Schedule 1. Get Enough Tax Taken Out of Pension Payments.

But you can take back your principal contributions even before age 59 12 as long as you dont. Income Taxes and Your Social Security Benefits. Even if you correctly execute an IRA rollover it is possible that your plan trustee or custodian will report it wrong on the 1099-R they issue to you and the IRS.

Free Federal and State Paycheck Withholding Calculator. This can be advantageous because money held in a Roth accumulates interest dividends and capital gains that are often tax-free. Your state withholding may be affected by the following criteria.

Traditional IRA contributions. Avoid a Surprise Tax Bill. IRS Withholding Calculator Can Help Social Security.

The forms can be mailed to us at the address shown at the top of the distribution form or faxed to us at 866-468-6268. Heres how a Roth IRA works who qualifies and FAQs. There are exceptions to the 10 percent penalty such as using IRA funds to pay your medical insurance premium after a job loss.

Reporting Rollover Transactions On Tax Return. IRA rollovers are reported on your tax return but as a non-taxable transaction. If you dont use a distribution from your HSA for qualified medical expenses you must pay tax on the distribution.

Tax Guide for Aliens. If your distribution is an eligible rollover distribution you do not have the option of electing not to have State income tax withheld from the distribution. Before Tax Cafeteria Plan Benefits.

If so the plan administrator must withhold 20 for federal income taxes. 2022 W-4 Help for Sections 2 3 and 4. Select the checkbox that reads Had withholding or made estimated payments for income such as dividends interest distributions from an IRA not Roth IRAs 401k or a trust or other form of specialized income on Step 1.

The Internal Revenue Service IRS wont tax you twice on the money you contribute to a Roth IRA although you do have to maintain the account for at least five years and as with traditional IRAs you must be at least age 59 12 before you take distributions to avoid a penalty. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. I have seen this occur many times in my career.

Eligibility to roll over a distribution. Government Civilian Employees Stationed Abroad. The tax information in the calculator is not intended as a substitute for specific.

When you do these nonperiodic distributions will be considered part of your taxable income. You may have to pay an additional 20 tax on your taxable distribution. Oregon personal income tax withholding and calculator Currently selected.

Individual Income Tax Return or Form 1040-SR US. The CARES Act passed in March of 2020 temporarily waived required minimum distributions RMDs for all types of retirement plans including IRAs 401ks 403bs 457bs and inherited IRA plans for calendar year 2020. 116-94 clarifies that employees described in section 414e3B which include ministers employees of a tax-exempt church-controlled organization including a nonqualified church-controlled organization and employees who are included in a church plan under certain circumstances after separation from the.

And because 401ks are funded with before-tax dollars youll still have to pay taxes on anything you take out even after the age of 59 ½. Retirement Plan and IRA Required Minimum Distributions FAQs IRS. To learn more see Publication 505.

You can roll the money over into an IRA or another tax-free pension plan yourself. If I took a coronavirus-related distribution from a retirement plan or IRA when do I have to pay taxes on the distribution. Tax Withholding and Estimated Tax at wwwirsgov.

The distribution is from an IRA or from amounts attributable to elective deferrals under a section 401k or 403b plan or a similar arrangement. If you only have one traditional IRA the amount of the distribution to be taxed equals the account balance on the conversion date minus any nondeductible contributions. State Additional Withholding Amount.

The transaction is treated as a distribution from the traditional IRA followed by a contribution of the distributed amount to the new Roth account. If you withdraw money from your traditional IRA before age 59 12 theres a 10 early withdrawal penalty and that is in addition to the income tax due on each withdrawal. Report the amount on Form 8889 and file it with your Form 1040 1040-SR or 1040-NR.

Plus review your projected RMDs over 10 years and over your lifetime. A Roth IRA is a retirement account in which after-tax money grows tax-free and withdrawals are tax-free. Although 401k plans are known for their tax-deferral benefits some allow after-tax contributions.

You can roll over after-tax 401k money to a Roth IRA without penalty when you retire or change jobs. 505 Tax Withholding and Estimated Tax. Generally early withdrawal from an Individual Retirement Account IRA prior to age 59½ is subject to being included in gross income plus a 10 percent additional tax penalty.

Free Federal and Missouri Paycheck Withholding Calculator. When you start taking withdrawals you then need to report the appropriate amounts as income on your tax return and.

How To Calculate Income Tax In Excel

Taxes On Stocks How Do They Work Forbes Advisor

Dividend Gross Up And A Dividend Tax Credit Mechanism

How To Calculate Income Tax In Excel

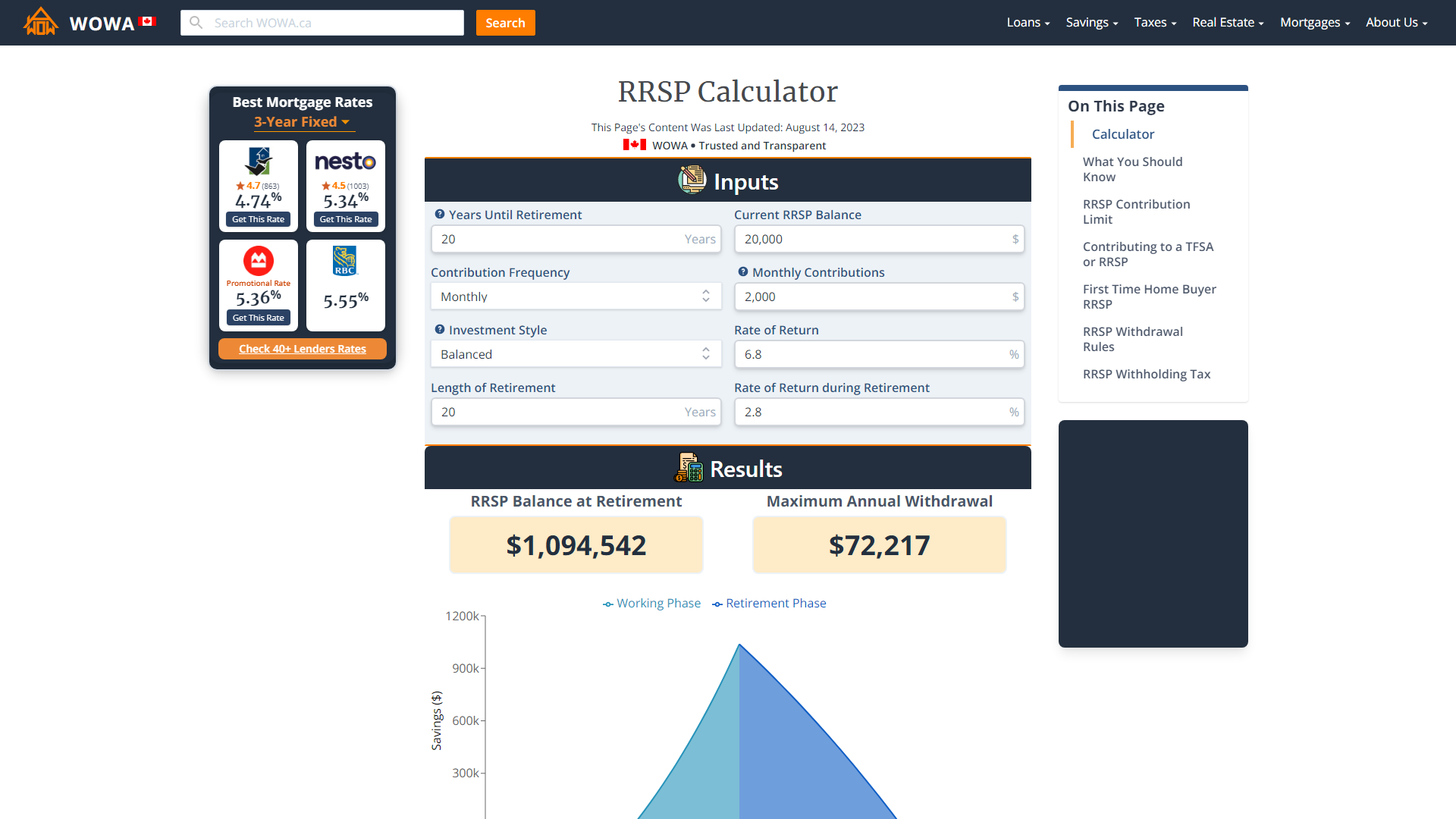

Rrsp Savings Calculator Wowa Ca

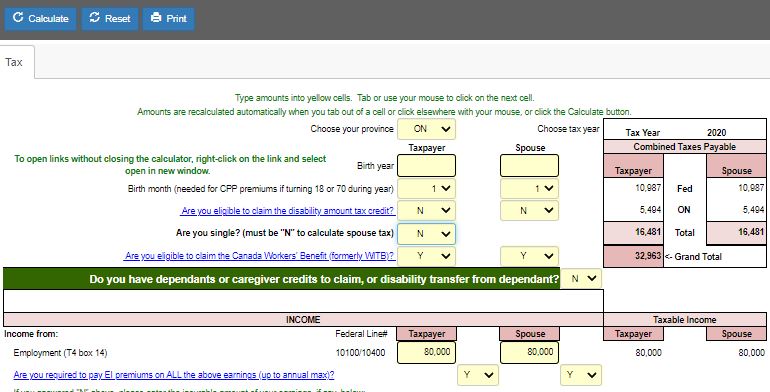

Taxtips Ca 2020 Canadian Income Tax And Rrsp Savings Calculator

Payroll Taxes Aren T Being Calculated Using Ira Deduction

Excel Formula Income Tax Bracket Calculation Exceljet

Help In Preparing For 2021 Tax Season Financial Analysis Taxes Humor Bank Jobs

Retirement Withdrawal Calculator For Excel

How To Calculate Income Tax In Excel

Taxtips Ca 2019 Quebec Income Tax And Rrsp Savings Calculator

How To Calculate Income Tax In Excel

Simple Tax Refund Calculator Or Determine If You Ll Owe

How To Calculate Taxable Income H R Block

Tax Calculator Estimate Your Income Tax For 2022 Free

Pin On Elder Law